For many years, governments and organizations around the world focused on taking the cash transactions to online mode because of various advantages such as documented exchanges, proper tracking, reducing currency manufacturing costs, and large handlings. Although a large number of people around the globe were using online payment methods, still, it was a very tiny fraction of the total transactions. And then the COVID-19 pandemic came into existence in 2020. As is said, everything has its own set of advantages and disadvantages. Although it hit the economy hard, on the brighter side, it also increased the number of online contactless payments exponentially.

Along with many other things that are becoming the new normal, the novel coronavirus pandemic is changing how we think about paying. More and more people are worried about catching coronavirus from touching cash and credit-card terminals. Among the various contactless payments methods that have gained fame in recent months, Apple Pay occupies one of the top spots in the list.

Why should you use Apple Pay?

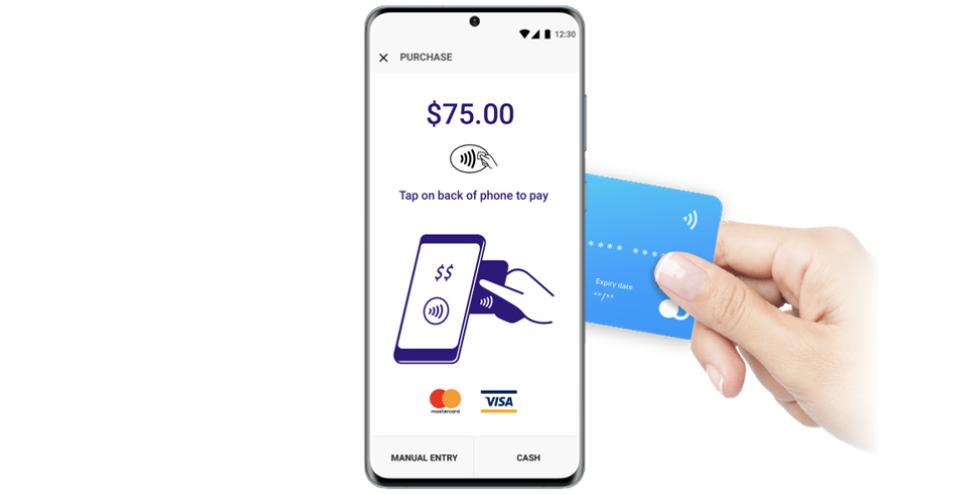

Apple Pay is Apple’s mobile payments service that gives its users an easy, secure, and private way to pay in stores. Various shops and departmental stores that include some big names in the sector also accept Apple Pay as a form of payment from the customers. It is quite flexible, and you can either use it within apps or on the web using their Apple device that they carry with them.

- Apple Pay is quite fast in completing transactions. It is even faster than accepting traditional credit and debit cards and other payment methods.

- If you are a regular Apple Pay customer, cards and cash will become a thing of the past because of its utility.

- Every transaction whether within the app or website can be tracked very easily and quickly so that you can always keep track of your expenses.

- It is also more secure than accepting traditional credit, debit, and prepaid cards. Every transaction you make requires a Face ID, Touch ID, or passcode set by you to complete.

- As an added security feature, the actual credit or debit card numbers are not exchanged after a transaction. It is beneficial for both the customers as their privacy isn’t compromised, and the payment acceptors also don’t need to deal with the card numbers.

As the Coronavirus pandemic is showing no signs of slowing down in the recent future, leave alone in 2020, it is very important to take strict precautions to protect ourselves from the grasp of the virus. And one of the most important rules to follow is to avoid unnecessary contacts that apply to cash and coins too. The less you put your hands on something, the less risk you have in catching the infection.

According to the recent study held in the United States, the most affected country in the world, around 55% of consumers are worried about handling cash as it poses a risk of catching the virus. And around 82% of consumers believe that contactless payments are a cleaner way to pay for the goods, which shows the change of mindset among the people and an inclination to move to online transactions whenever required.

Conclusion

As technology is progressing day by day, it is quite clear that a lion’s share of the transactions around the world will take place online in the next few decades through leading platforms like Apple Pay. However, the good thing is that the change is nothing negative. According to Jordan McKee, an analyst at 451 Research, “It’s behavior that’s going to stick after stay at home ends,” and that’s a wonderful behavior to develop. You save the minting costs, as well as contribute a lot in making this planet a bit greener as millions of trees are cut every year to make those notes you are using now.